5 Tax and Structures

Company taxation

Australian companies generally pay a flat tax rate of 30% of their taxable income. However, this was reduced to 25% for small business companies (known as base rate entities) with aggregated turnover of less than $50 million from the 2021/22 financial year.

Unlike individuals, companies have no tax-free threshold and there is not a marginal tax rate. Companies are also not eligible to the tax offsets that individuals have an entitlement to.

In addition, companies don't benefit from any discount on capital gains they make from the sale of investments.

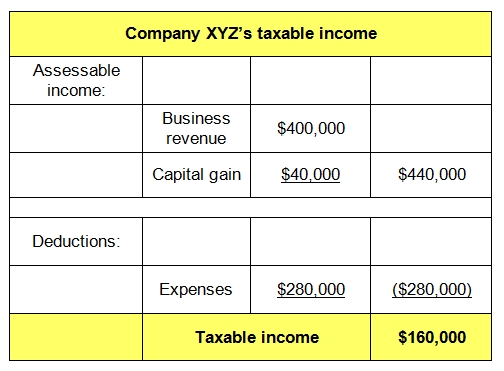

Assume your Company XYZ Pty Ltd has business revenue of $400,000, expenses of $280,000 and a capital gain of $40,000 on shares it sold. It qualifies as a small business.

The taxable income for Company XYZ is calculated in the table opposite.

Tax is then assessed at 25% of $160,000, which is $40,000.